Understanding your landscaping business’s accounting system

Bookkeeping and accounting help you track the success of your business, and it also saves you time during tax season. To learn how to get started and understand if you’re tracking the numbers correctly, simply keep reading. It shows you where to start and helps you understand when to bring in the pros. Most landscape accounting software solutions offer mobile access, allowing you to manage your business operations from anywhere at any time, thereby increasing productivity and flexibility. The best landscape accounting software can streamline your administrative tasks, manage finances, automate invoicing, and provide real-time business performance insights, enhancing productivity.

- This is why most landscaping businesses have recurring customers and accounting for lawn care business is essential to keep your business run without any hindrance.

- Bookkeeping is an essential part of running a successful landscaping business.

- It shows you where to start and helps you understand when to bring in the pros.

- With ZarMoney, businesses can manage sales orders efficiently, ensuring jobs are done on time.

Insight™ sets ZarMoney apart as the best landscape accounting software for landscaping businesses. Managing bills and expenses is a vital part of running a successful landscape business. ZarMoney simplifies this process, enabling business owners to maintain a healthy cash flow. Many owners of landscaping businesses outsource their bookkeeping to a professional service.

Understanding Bookkeeping for Landscaping Business

Purchase orders are necessary when tracking materials needed for a job, or to keep things tracked when working with subcontractors. A purchase order, also referred to as a PO, is a commercial document created by the buyer issued to a seller to indicated the type, quantities and agreed price for the products the purchaser is looking to buy. When buying large quantities of sod, plant materials, for a project it is important to keep inventory control and tracking to ensure you’re paying the agreed upon price of the product. If you bid a project based on an estimated cost, the purchase order will help track the order and payment of the products.

As a landscaper, managing expenses and income is crucial for running a profitable business. Landscapers can use bookkeeping to track their expenses and income, monitor their cash flow, and identify areas where they can cut costs or increase revenue. As a business, landscaping and lawn care can be great – until the slow season.

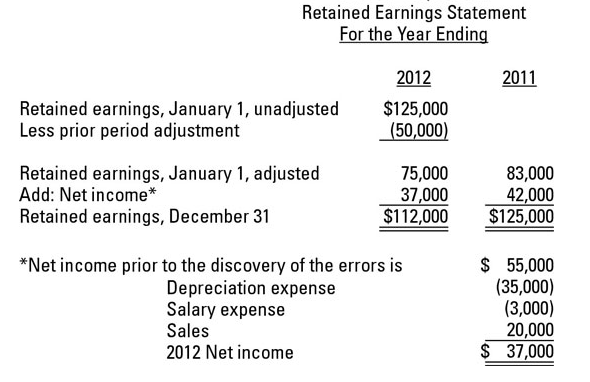

For any type of business in the high-growth stage, it’s advisable to use the accrual method of accounting. Accrual accounting gives a more balanced idea of a company’s financial health by recording anticipated or upcoming expenses and expected income. The main advantage of the cash method is that it’s straightforward to implement. It’s the structure most people use for their personal bookkeeping, and many small businesses also rely on it.

Accrual accounting reveals trends in cash flow statements and provides a data-backed vision of the future.

Fortunately, there are tools beyond basic accounting software like Quickbooks that will fast-track your company past typical growing pains. → One of the most foundational financial decisions Bookkeeping for landscaping business a company can make is choosing a cash basis or earned/accrual accounting method. Evaluating financial processes can be a hassle at best, especially if you’re unsure where to start.

Small business accounting services allow landscapers and construction workers to spend more time focusing on getting the job done instead of the intricate financial details. Bookkeeping provides landscapers with an accurate picture of their financial health. It allows them to track their income and expenses, monitor their cash flow, and identify areas where they can cut costs or improve efficiency. Good bookkeeping practices also help landscapers to create financial statements and reports that can be used to secure loans or attract investors. A professional bookkeeper from Golden Apple can keep track of your cash flow and categorize income and expenses accurately to help you with job costing and keep your finances watertight as your business grows. Having a proper bookkeeping strategy from the start is essential to ensure that you don’t leave money on the table with missed invoices or pay more tax than you should.

By offering this functionality, ZarMoney reinforces its position as the best landscape accounting software, making the landscape business management process smooth and hassle-free. Landscapers are required to pay taxes on their income and comply with tax reporting requirements. Effective bookkeeping practices can help landscapers to track their income and expenses, ensure compliance with tax laws, and make informed tax planning decisions.

Think of bookkeeping and accounting as tasks that help grow your small business every day and over a long period. Knowledge is power when making educated decisions to guide your landscaping business towards future growth. When it comes to monthly tasks, you should double-check your expense record in a process called reconciliation to ensure nothing was missed. It’s also important to send invoices at the end of every month to ensure timely payment and make sure that all of your bills are paid in full at the same time every month.

Payments Collected

There are only so many hours of daylight every day for a landscaping business to make an impact. You likely do not have the time to spend hours staring at a spreadsheet looking at your payroll, inventory, and invoices. With landscaping on your mind, you are likely not thinking about bookkeeping and accounting daily. Instead, you are thinking of proper lawn care to keep your customers happy. This method requires a more active approach on your end, but it will give you a clearer picture of your business’s cash flow.

When you submit your tax returns, you’ll have to choose between an accrual basis and a cash basis. The easiest of the two is the cash basis method, which tracks expenses that are paid out and when your income is received. Better Bookkeepers is the ultimate solution to your business bookkeeping needs. Get in touch with us and schedule a consultation to find out more about our bookkeeping for lawn care business owners like you. For example, a cash flow statement shows you when you are most likely to have extra cash on hand, allowing you to identify when you will be able to invest in new equipment. An accounts receivables report shows your unpaid invoices so you can ensure you’re not letting unpaid bills slip past.

Hiring a Bookkeeper for Your Landscaping Business

Inefficient scheduling can cause delays, customer dissatisfaction, and loss of revenue. Offering a comprehensive customer statement is integral for a lawn care company. ZarMoney’s customer management feature includes detailed customer statements that provide insights into the customer’s transaction history, ensuring transparency and enhancing customer trust. Timely fulfillment of sales orders is a keystone of customer service in the landscaping industry. With ZarMoney, businesses can manage sales orders efficiently, ensuring jobs are done on time. This not only streamlines payment processes but also accelerates the revenue cycle.

Connect With Industry Leading Apps To Level Up Your Accounting

Your landscaping business likely has a lot of accounting needs, such as estimates and invoicing, scheduling, managing inventory, and tracking sales. But, you don’t have to do all of this using a pen and paper or the dreaded Excel spreadsheet. Whether you’re new to online accounting software or just need help getting the most out of your current setup, we can help. Our services range from cleaning up your existing books to helping you choose the best type of accounting software to completely taking the burden of day to day accounting tasks off your shoulders. Bookkeepers help landscaping businesses record all of their business transactions so they’re ready for tax season.

Plus, FreshBooks accounting software will crunch the numbers for you so you’ll be confident when tax time rolls around. Installing the software and getting to a point where it’s working for you at an optimal level can be challenging. Here at Better Bookkeepers, we’ve installed QuickBooks with countless clients. Not only can you ensure a seamless installation process by hiring us, but we’ll set it up to serve your business optimally and ensure you have a good understanding of how it works. To ensure you can use QuickBooks to its fullest potential, we’ll also train you on the intricacies of the software.

An inability to manage inventory effectively can lead to project delays and lost profits. With ZarMoney, landscape business owners have a clear picture of their resources at any given moment. These are huge costs of doing business that literally will never show up in a standard accounting P/L statement, but they are critical to your company from a cash flow standpoint. Be sure you also include these two costs of doing business in your process of setting profitable hourly rates. If your financial teams aren’t in a place to properly manage an accrual accounting system, it can lead to certain pitfalls.