Balance sheet Wikipedia

It’s important to note that how a balance sheet is formatted differs depending on where an organization is based. The example above complies with International Financial Reporting Standards (IFRS), which companies outside the United States follow. In this balance sheet, accounts are listed from least liquid to most liquid (or how quickly they can be converted into cash). Because companies invest in assets to fulfill their mission, you must develop an intuitive understanding of what they are.

Current liabilities include rent, utilities, taxes, current payments toward long-term debts, interest payments, and payroll. Includes non-AP obligations that are due within one year’s time or within one operating cycle for the company (whichever is longest). Notes payable may also have a long-term version, which includes notes with a maturity of more than one year. Explore our online finance and accounting courses, which can teach you the key financial concepts you need to understand business performance and potential.

Company

The first is money, which is contributed to the business in the form of an investment in exchange for some degree of ownership (typically represented by shares). The second is earnings that the company generates over time and retains. If you were to add up all of the resources a business owns (the assets) and subtract all of the claims from third parties (the liabilities), the residual leftover is the owners’ equity. Balance sheets help you see whether a business is succeeding or struggling.

- Some companies issue preferred stock, which will be listed separately from common stock under this section.

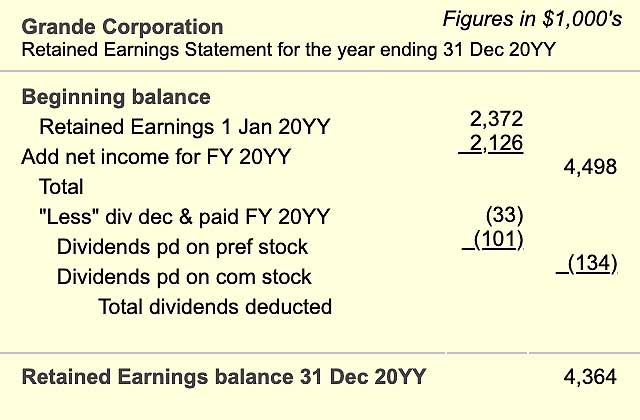

- Retained earnings are the net earnings a company either reinvests in the business or uses to pay off debt.

- If splitting your payment into 2 transactions, a minimum payment of $350 is required for the first transaction.

- As the company pays off its AP, it decreases along with an equal amount decrease to the cash account.

- Equity can also drop when an owner draws money out of the company to pay themself or when a corporation issues dividends to shareholders.

- QuickBooks’ balance sheet templates allow for all of the customizations you need to make to tailor it to your own business.

Different accounting systems and ways of dealing with depreciation and inventories will also change the figures posted to a balance sheet. Because of this, managers have some ability to game the numbers to look more favorable. Pay attention to the balance sheet’s footnotes in order to determine which systems are being used in their accounting and to look out for red flags. Some companies issue preferred stock, which will be listed separately from common stock under this section. Preferred stock is assigned an arbitrary par value (as is common stock, in some cases) that has no bearing on the market value of the shares. The common stock and preferred stock accounts are calculated by multiplying the par value by the number of shares issued.

Why is the balance sheet important?

Investopedia defines an asset as “Anything of value that can be converted into cash.” In other words, an asset provides economic value to businesses and organizations. Balance sheets and income statements are important tools to help you understand the finances and prospects of your business, but the two differ in key ways. Knowing when to use each is helpful in creating visibility into the financial health of your business. Business owners and accountants can use it to measure the financial health of an organization. However, balance sheets should be used in conjunction with other analysis tools whenever possible.

For Where’s the Beef, let’s say you invested $2,500 to launch the business last year, and another $2,500 this year. You’ve also taken $9,000 out of the business to pay yourself and you’ve left some profit in the bank. Prepaid expenses includes any prepayment that is expected to be used within one year. The comparative balance sheet presents multiple columns of amounts, and as a result, the heading will be Balance Sheets.

Balance Sheet

Another way to examine the balance sheet report is by conducting a vertical analysis of the balance sheet. Vertical analysis is a method of looking at the financial statement by looking at each line as a percentage of some predetermined base figure from the statement. Next up on your balance sheet, you’ll see your liabilities (i.e., what a business owes others). Liabilities, like assets, are classified as current (due within a year) and long-term (the due date is more than a year away). You can find balance sheet formats and templates with a quick Google search.

- Any amount remaining (or exceeding) is added to (deducted from) retained earnings.

- The balance sheet is a picture of the store’s health therefore the store must record all assets and liabilities.

- A balance sheet is a statement of a business’s assets, liabilities, and owner’s equity as of any given date.

- In this balance sheet, accounts are listed from least liquid to most liquid (or how quickly they can be converted into cash).

Accounting systems or depreciation methods may allow managers to change things on balance sheets. Some executives may fiddle with balance sheets to make them look more profitable than they actually are. Thus, anyone reading a balance sheet must examine footnotes in detail to make sure there aren’t any red flags. It can help you better understand what information these sheets include.

Components of the balance sheet

The left side of the balance sheet outlines all of a company’s assets. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. For public companies based in the U.S. that follow GAAP guidelines, all accounts are listed from most to least liquid (most easily converted to cash to least easy to convert).

If a company takes out a five-year, $4,000 loan from a bank, its assets (specifically, the cash account) will increase by $4,000. Its liabilities (specifically, the long-term debt account) will also increase by $4,000, balancing the two sides of the equation. If the company takes $8,000 from investors, its assets will increase by that amount, as will its shareholder equity.

What Are the Components of Balance Sheet Report?

Stockholder (or shareholder) equity is the value of the business after all debts and liabilities have been settled. The principal of the loans payable over the accounting period are only included on the Balance Sheet, as are the payments due in that time on a leasing agreement. Most business owners don’t dive into entrepreneurship because they are excited about the accounting process, but a basic understanding of accounting sets a successful business apart from those that struggle. Fortunately, many places and people are willing to help you learn, including your accountant, your bookkeeper (if you employ one and don’t do the books yourself), as well as the resources at SCORE.

Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet. The current portion of longer-term borrowing, such as the latest interest payment on a 10-year loan, is also recorded as a current liability. Lastly, inventory represents the company’s raw materials, work-in-progress goods, and finished goods.

If your business is doing well, investors can look at your balance sheet and see if you have a profitable business they’d like to invest in. It can also help you diagnose problems, pinpoint financial strengths, and keep track of your business’ financial performance over time. It helps assess financial health using ratios, such as current ratio, debt-to-equity ratio and return on shareholder’s equity. This segment of the balance sheet includes return of equity (ROE), calculated by dividing net income by shareholder’s equity. ROE measures management’s effectiveness in employing and driving returns based on equity. Cash includes all liquid, short-term investments that are easily convertible into cash.

The liabilities section is broken out similarly as the assets section, with current liabilities and non-current liabilities reporting balances by account. The total shareholder’s equity section reports common stock value, retained earnings, and accumulated other comprehensive income. Apple’s total liabilities increased, total equity decreased, and the combination of the two reconcile to the company’s total assets. The balance sheet includes information about a company’s assets and liabilities, and the shareholders’ equity that results.

Does AZEK (NYSE:AZEK) Have A Healthy Balance Sheet? – Simply Wall St

Does AZEK (NYSE:AZEK) Have A Healthy Balance Sheet?.

Posted: Wed, 16 Aug 2023 16:10:51 GMT [source]

You can use this Google Sheet to enter the numbers for your company and get a better idea of how a balance sheet works. It also includes other financial statements, like an income statement and cash flow statement to improve your bookkeeping as a business owner. Accountants and corporate finance teams are responsible for making balance sheets and other financial statements like cash flow statements. However, accountants and other financial team members also use these sheets to quickly calculate company performance metrics, like the current ratio. This financial statement lists everything a company owns and all of its debt.